AP automation helps companies save time and improve financial controls. AP automation software was designed as the genesis for improvement initiatives in modern accounting. Whereas traditional accounts payable teams are burdened by overhead, manual data entry, and inefficiencies, automation software streamlines the full cycle of accounts. Forward-thinking CFOs drive efficiency and cost savings with accounts payable automation. CFOs in growing companies face more challenges than ever before. Automating accounts payable (AP) can help CFOs meet those challenges head on. The best AP automation solutions provide visibility, reclaim time, and are business-ready. AP Automation 5 Signs You've Outgrown Your Accounts Payable Process – and What to Do Next. For accountants, getting an invoice approved on time or paying vendors before a looming deadline is always a clear win – but for most finance teams, the reality isn't that simple.

- Accounts Payable Automation Companies

- Accounts Payable Automation Quickbooks Online

- Best Accounts Payable Automation

- Best Practices Accounts Payable Automation

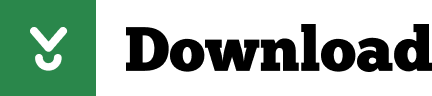

Accounts Payable is usually seen as a back-office function. Because AP staff spends most of their time processing transactions through manual and paper-based tasks, they don't have much opportunity to add strategic value to the enterprise's activities.

By Lindsay Pinkos, Senior Product Marketing Manager at Kofax.

Accounts Payable is usually seen as a back-office function. Because AP staff spends most of their time processing transactions through manual and paper-based tasks, they don't have much opportunity to add strategic value to the enterprise's activities. But times are changing.

As many organizations shift to a digital, remote-work model, Accounts Payable has had to confront new challenges. By embracing intelligent automation, AP teams have been able to rise to the moment. In fact, traditional AP processes are ripe for automation, and AP departments that take advantage of it are discovering operational efficiencies and providing real-time insight into the workings of the enterprise.

AP challenges for a digital, remote workforce

Remote work has had a significant impact on Accounts Payable operations. Existing challenges have become more complex, even as new ones have emerged. Some of the primary issues AP teams face today are:

Increased risk from paper-based processes:

Manual, paper-driven processes are time-consuming and prevent employees from working on higher-value tasks. They also create risk, as they make it difficult to document chain of custody and maintain an audit trail. With many employees working from home on personal, and potentially insecure, networks, manual processes are even slower and riskier. In fact, 25 percent of AP leaders worry that inefficiencies within their department have created additional perils.

Negative impact on the bottom line due to late payments:

Manual processes take even longer to complete when the workforce is remote, contributing to chronic late payments and associated penalties that hurt the bottom line. Organizations risk jeopardizing relationships with valued suppliers and may even be placed on a late-payment blacklist.

Lack of visibility into cash flow and spend patterns:

Paper-based processes leave data unorganized and inaccessible for larger strategic analysis. It's difficult to monitor process execution, exceptions and approvals. Remote work has only made the situation worse, with nearly half of AP departments lacking real-time visibility into corporate spend.

Three steps to reinventing AP with automation

As companies in all sectors struggle to recover from public-health and economic upheaval, AP leaders have had to reinvent their workflows. By leveraging intelligent automation, they've transformed their departments from paper-based transactional teams into strategic advisors that actively contribute to growth.

There are three objectives AP leaders should focus on as they shift to digital automation:

- Day-to-day invoice processing automation: AP staff waste too much time manually keying thousands of invoices into enterprise systems. When AP departments leverage automation, invoices can be processed in less than one-fifth the time. Intelligent automation capabilities such as automated email capture and electronic invoice processing enable AP to seamlessly ingest invoice data across multiple channels. And, as e-invoicing becomes more popular, automation makes it easy to keep up with rising volumes, regardless of which channel invoices come through.

- AP process standardization: Standardized AP processes create efficiencies and provide reliable data that can be used to make smart operational decisions. Automated digital workflows make sure segregation of duties are enforced and create a chain of custody. Pre-set business rules automatically route documents that require review and approval, and AP teams can manage exceptions and execute processes more consistently and efficiently.

- Operational insight delivery: Demand for real-time visibility into AP information has increased four-fold between 2018 and 2020, according to the IOFM Future of Accounts Payable Study. Automation frees up employees from manual, transactional work so they can focus on strategic thinking. Automation technologies also gather and analyze data that identifies patterns, which can be used to make decisions around working capital, spending, process efficiency, budget monitoring, payment-term optimization and more.

AP departments that want to transform into a strategic business unit need the right automation solutions that deliver real digital transformation. The pressure is on to move fast and a SaaS-based solution delivers rapid ROI, making it a good place to start.

The solution should also easily integrate with your organization's Enterprise Resource Planning (ERP) systems, so you can avoid implementation headaches. The best solutions also leverage machine learning (ML) and artificial intelligence (AI), ensuring AP can process documents in any format and across multiple channels.

Say goodbye to AP's reactive and transactional workflows. Intelligent automation unleashes a gold mine of data that drives proactive business decision-making and digitally transforms processes and teams. It's time to move AP into the boardroom and work like tomorrow— today.

Accounts Payable Automation Companies

Accounts payable (AP) is money owed by a business to its suppliers shown as a liability on a company's balance sheet. It is distinct from notes payable liabilities, which are debts created by formal legal instrument documents.[1]

Overview[edit]

An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding, or open, liability because it has not been paid. Payables are often categorized as Trade Payables, payables for the purchase of physical goods that are recorded in Inventory, and Expense Payables, payables for the purchase of goods or services that are expensed. Common examples of Expense Payables are advertising, travel, entertainment, office supplies and utilities. AP is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received. Suppliers offer various payment terms for an invoice. Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is madewithin 30 days. If the payment is made on Day 31 then the full amount is paid. This is also referred to as 2/10 Net 30.[2]

In households, accounts payable are ordinarily bills from the electric company, telephone company, cable television or satellite dish service, newspapersubscription, and other such regular services. Householders usually track and pay on a monthly basis by hand using cheques, credit cards or internet banking. In a business, there is usually a much broader range of services in the AP file, and accountants or bookkeepers usually use accounting software to track the flow of money into this liability account when they receive invoices and out of it when they make payments. Increasingly, large firms are using specialized Accounts Payable automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization's invoices.

Commonly, a supplier will ship a product, issue an invoice, and collect payment later. This is a cash conversion cycle, or a period of time during which the supplier has already paid for raw materials but hasn't been paid in return by the final customer.

When the invoice is received by the purchaser, it is matched to the packing slip and purchase order, and if all is in order, the invoice is paid. This is referred to as the three-way match.[3] The three-way match can slow down the payment process, so the method may be modified. For example, three-way matching may be limited solely to large-value invoices, or the matching is automatically approved if the received quantity is within a certain percentage of the amount authorized in the purchase order.[4] Invoice processing automation software handles the matching process differently depending upon the business rules put in place during the creation of the workflow process. The simplest case is the two way matching between the invoice itself and the purchase order.

Internal controls[edit]

A variety of checks against abuse are usually present to prevent embezzlement by accounts payable personnel. Segregation of duties is a common control. In countries where cheques payment are common nearly all companies have a junior employee process and print a cheque and a senior employee review and sign the cheque. Often, the accounting software will limit each employee to performing only the functions assigned to them, so that there is no way any one employee – even the controller – can singlehandedly make a payment.

Some companies also separate the functions of adding new vendors and entering vouchers. This makes it impossible for an employee to add himself as a vendor and then cut a cheque to himself without colluding with another employee. This file is referred to as the master vendor file. It is the repository of all significant information about the company's suppliers. It is the reference point for accounts payable when it comes to paying invoices.[5]

In addition, most companies require a second signature on cheques whose amount exceeds a specified threshold.

Accounts payable personnel must watch for fraudulent invoices. In the absence of a purchase order system, the first line of defense is the approving manager. However, AP staff should become familiar with a few common problems, such as 'Yellow Pages' ripoffs in which fraudulent operators offer to place an advertisement. The walking-fingers logo has never been trademarked, and there are many different Yellow Pages-style directories, most of which have a small distribution. According to an article in the Winter 2000 American Payroll Association's Employer Practices, 'Vendors may send documents that look like invoices but in small print they state 'this is not a bill.' These may be charges for directory listings or advertisements. Recently, some companies have begun sending what appears to be a rebate or refund check; in reality, it is a registration for services that is activated when the document is returned with a signature.'

In accounts payable, a simple mistake can cause a large overpayment. A common example involves duplicate invoices. An invoice may be temporarily misplaced or still in the approval status when the vendors calls to inquire into its payment status. After the AP staff member looks it up and finds it has not been paid, the vendor sends a duplicate invoice; meanwhile the original invoice shows up and gets paid. Then the duplicate invoice arrives and inadvertently gets paid as well, perhaps under a slightly different invoice.

Audits of accounts payable[edit]

Auditors often focus on the existence of approved invoices, expense reports, and other supporting documentation to support checks that were cut. The presence of a confirmation or statement from the supplier is reasonable proof of the existence of the account. It is not uncommon for some of this documentation to be lost or misfiled by the time the audit rolls around. An auditor may decide to expand the sample size in such situations.

Auditors typically prepare an aging structure of accounts payable for a better understanding of outstanding debts over certain periods (30, 60, 90 days, etc.). Such structures are helpful in the correct presentation of the balance sheet as of fiscal year end.[6]

Automation[edit]

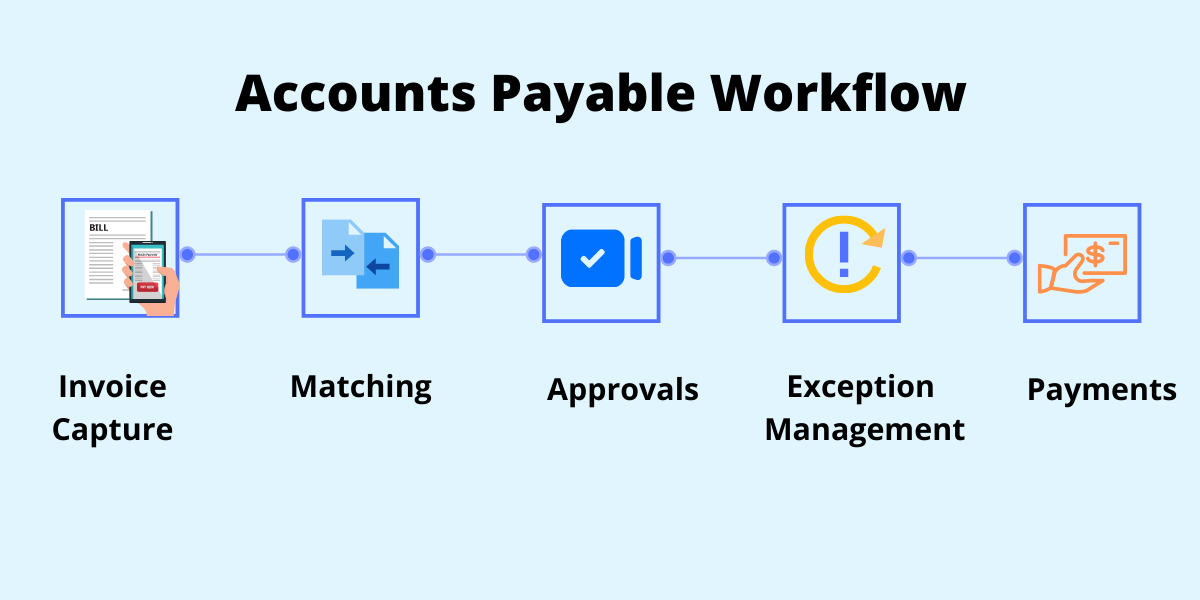

Accounts payable [1] or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments. The accounts payable department's main responsibility is to process and review transactions between the company and its suppliers. In other words, it is the accounts payable department's job to make sure all outstanding invoices from their suppliers are approved, processed, and paid. Processing an invoice includes recording important data from the invoice and inputting it into the company's financial, or bookkeeping, system. After this is accomplished, the invoices must go through the company's respective business process in order to be paid.[7]

This process is straightforward but can become very cumbersome, especially if the company has a very large number of invoices. This problem is compounded when invoices that require processing are on paper. This can lead to lost invoices, human error during data entry, and invoice duplicates. These and other problems lead to a high cost per invoice metric. The goal of automating the accounts payable department is to streamline this invoicing process, eliminate potential human error, and lower the cost per invoice[8]

Some of the most common AP automation solutions include E-invoicing, scanning and workflow, online tracking, reporting capabilities, electronic invoice user interfaces, supplier networks, payment services and spend analytics for all invoices.[9]

Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. (Financial Operations Networks, 2008) These solutions usually involve a third party company that provides and supports an application which allows a supplier to submit an electronic invoice to their customer for immediate routing, approval, and payment. These applications are tied to databases which archive transaction information between trading partners. (US Bank, Scott Hesse, 2010) The invoices may be submitted in a number of ways, including EDI, CSV, or XML uploads, PDF files, or online invoice templates. Because E-invoicing includes so many different technologies and entry options, it is an umbrella category for any method by which an invoice is electronically presented to a customer for payment.[10]

Enterprise resource planning systems typically use software to provide integrated business process management services to enterprises.[11]

Accounts Payable Automation Quickbooks Online

History[edit]

Since the mid 1960s companies have begun to establish data links between their trading partners to transfer documents, such as invoices and purchase orders. Inspired by the idea of a paperless office and more reliable transfer of data, they developed the first EDI systems. These systems were unique to the respective company that developed them, meaning they were difficult to deploy across a large number of corporations. Recognizing this, the Accredited Standards Committee X12—a standards institution under the umbrella of ANSI—made preparations to standardize EDI processes. This resulted in what is known today as the ANSI X12 EDI standard.[12]

This remained the main way to exchange transactional data between trading partners for nearly 3 decades. The 1990s came with advances in internet technology. Companies began to appear offering more robust user interface web applications with functions that catered to both supplier and customer. These new web-based applications allowed for online submission of individual invoices as well as EDI file uploads. Along with other methods of file uploads including CSV and XML. These services allow suppliers to present invoices to their customers for matching and approval via a user-friendly web application. Suppliers can also see a history of all the invoices they submitted to their customer without having direct access to the customers' systems. This is because all the transactional information is stored in the data centers of the third party company that provides the invoicing web app. This proprietary information can be regulated by the customer in order to control how much transactional information the vendor is allowed to see. (For example, payment dates, or check information).[13]

As companies advance into the digital era, more and more are switching to electronic invoicing services to automate their accounts payable departments. Some even believe it to be an industry standard in the near future. According to a report done by the GXS team in 2013, Europe is adopting government legislation encouraging businesses to adopt electronic invoicing practices. The United States has no such legislation yet but does recognize the value of this technology. The US Treasury estimated that implementing e-invoicing across the entire federal government would reduce cost by 50% and save $450 million annually.[14]

Best Accounts Payable Automation

With the increasing availability of robotic solutions, businesses are driving process improvement in AP even further. By applying end-to-end robotic process automation or RPA to their accounts payable department, organizations can accelerate invoice processing speed and accuracy while improving operational costs.[15] Some organizations report that by implementing RPA they have managed to almost completely eliminate human intervention from the AP process, thus saving 65% to 75% of the time that was previously had spent on manual processing.[16]

See also[edit]

Overview[edit]

An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouched for payment. Vouchered, or vouched, means that an invoice is approved for payment and has been recorded in the General Ledger or AP subledger as an outstanding, or open, liability because it has not been paid. Payables are often categorized as Trade Payables, payables for the purchase of physical goods that are recorded in Inventory, and Expense Payables, payables for the purchase of goods or services that are expensed. Common examples of Expense Payables are advertising, travel, entertainment, office supplies and utilities. AP is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received. Suppliers offer various payment terms for an invoice. Payment terms may include the offer of a cash discount for paying an invoice within a defined number of days. For example, 2%, Net 30 terms mean that the payer will deduct 2% from the invoice if payment is madewithin 30 days. If the payment is made on Day 31 then the full amount is paid. This is also referred to as 2/10 Net 30.[2]

In households, accounts payable are ordinarily bills from the electric company, telephone company, cable television or satellite dish service, newspapersubscription, and other such regular services. Householders usually track and pay on a monthly basis by hand using cheques, credit cards or internet banking. In a business, there is usually a much broader range of services in the AP file, and accountants or bookkeepers usually use accounting software to track the flow of money into this liability account when they receive invoices and out of it when they make payments. Increasingly, large firms are using specialized Accounts Payable automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization's invoices.

Commonly, a supplier will ship a product, issue an invoice, and collect payment later. This is a cash conversion cycle, or a period of time during which the supplier has already paid for raw materials but hasn't been paid in return by the final customer.

When the invoice is received by the purchaser, it is matched to the packing slip and purchase order, and if all is in order, the invoice is paid. This is referred to as the three-way match.[3] The three-way match can slow down the payment process, so the method may be modified. For example, three-way matching may be limited solely to large-value invoices, or the matching is automatically approved if the received quantity is within a certain percentage of the amount authorized in the purchase order.[4] Invoice processing automation software handles the matching process differently depending upon the business rules put in place during the creation of the workflow process. The simplest case is the two way matching between the invoice itself and the purchase order.

Internal controls[edit]

A variety of checks against abuse are usually present to prevent embezzlement by accounts payable personnel. Segregation of duties is a common control. In countries where cheques payment are common nearly all companies have a junior employee process and print a cheque and a senior employee review and sign the cheque. Often, the accounting software will limit each employee to performing only the functions assigned to them, so that there is no way any one employee – even the controller – can singlehandedly make a payment.

Some companies also separate the functions of adding new vendors and entering vouchers. This makes it impossible for an employee to add himself as a vendor and then cut a cheque to himself without colluding with another employee. This file is referred to as the master vendor file. It is the repository of all significant information about the company's suppliers. It is the reference point for accounts payable when it comes to paying invoices.[5]

In addition, most companies require a second signature on cheques whose amount exceeds a specified threshold.

Accounts payable personnel must watch for fraudulent invoices. In the absence of a purchase order system, the first line of defense is the approving manager. However, AP staff should become familiar with a few common problems, such as 'Yellow Pages' ripoffs in which fraudulent operators offer to place an advertisement. The walking-fingers logo has never been trademarked, and there are many different Yellow Pages-style directories, most of which have a small distribution. According to an article in the Winter 2000 American Payroll Association's Employer Practices, 'Vendors may send documents that look like invoices but in small print they state 'this is not a bill.' These may be charges for directory listings or advertisements. Recently, some companies have begun sending what appears to be a rebate or refund check; in reality, it is a registration for services that is activated when the document is returned with a signature.'

In accounts payable, a simple mistake can cause a large overpayment. A common example involves duplicate invoices. An invoice may be temporarily misplaced or still in the approval status when the vendors calls to inquire into its payment status. After the AP staff member looks it up and finds it has not been paid, the vendor sends a duplicate invoice; meanwhile the original invoice shows up and gets paid. Then the duplicate invoice arrives and inadvertently gets paid as well, perhaps under a slightly different invoice.

Audits of accounts payable[edit]

Auditors often focus on the existence of approved invoices, expense reports, and other supporting documentation to support checks that were cut. The presence of a confirmation or statement from the supplier is reasonable proof of the existence of the account. It is not uncommon for some of this documentation to be lost or misfiled by the time the audit rolls around. An auditor may decide to expand the sample size in such situations.

Auditors typically prepare an aging structure of accounts payable for a better understanding of outstanding debts over certain periods (30, 60, 90 days, etc.). Such structures are helpful in the correct presentation of the balance sheet as of fiscal year end.[6]

Automation[edit]

Accounts payable [1] or AP automation is the ongoing effort of many companies to streamline the business process of their accounts payable departments. The accounts payable department's main responsibility is to process and review transactions between the company and its suppliers. In other words, it is the accounts payable department's job to make sure all outstanding invoices from their suppliers are approved, processed, and paid. Processing an invoice includes recording important data from the invoice and inputting it into the company's financial, or bookkeeping, system. After this is accomplished, the invoices must go through the company's respective business process in order to be paid.[7]

This process is straightforward but can become very cumbersome, especially if the company has a very large number of invoices. This problem is compounded when invoices that require processing are on paper. This can lead to lost invoices, human error during data entry, and invoice duplicates. These and other problems lead to a high cost per invoice metric. The goal of automating the accounts payable department is to streamline this invoicing process, eliminate potential human error, and lower the cost per invoice[8]

Some of the most common AP automation solutions include E-invoicing, scanning and workflow, online tracking, reporting capabilities, electronic invoice user interfaces, supplier networks, payment services and spend analytics for all invoices.[9]

Electronic Invoicing can be a very useful tool for the AP department. Electronic invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed and processed. Because invoice arrival and presentation is almost immediate invoices are paid sooner; therefore, the amount of time and money it takes to process these invoices is greatly reduced. (Financial Operations Networks, 2008) These solutions usually involve a third party company that provides and supports an application which allows a supplier to submit an electronic invoice to their customer for immediate routing, approval, and payment. These applications are tied to databases which archive transaction information between trading partners. (US Bank, Scott Hesse, 2010) The invoices may be submitted in a number of ways, including EDI, CSV, or XML uploads, PDF files, or online invoice templates. Because E-invoicing includes so many different technologies and entry options, it is an umbrella category for any method by which an invoice is electronically presented to a customer for payment.[10]

Enterprise resource planning systems typically use software to provide integrated business process management services to enterprises.[11]

Accounts Payable Automation Quickbooks Online

History[edit]

Since the mid 1960s companies have begun to establish data links between their trading partners to transfer documents, such as invoices and purchase orders. Inspired by the idea of a paperless office and more reliable transfer of data, they developed the first EDI systems. These systems were unique to the respective company that developed them, meaning they were difficult to deploy across a large number of corporations. Recognizing this, the Accredited Standards Committee X12—a standards institution under the umbrella of ANSI—made preparations to standardize EDI processes. This resulted in what is known today as the ANSI X12 EDI standard.[12]

This remained the main way to exchange transactional data between trading partners for nearly 3 decades. The 1990s came with advances in internet technology. Companies began to appear offering more robust user interface web applications with functions that catered to both supplier and customer. These new web-based applications allowed for online submission of individual invoices as well as EDI file uploads. Along with other methods of file uploads including CSV and XML. These services allow suppliers to present invoices to their customers for matching and approval via a user-friendly web application. Suppliers can also see a history of all the invoices they submitted to their customer without having direct access to the customers' systems. This is because all the transactional information is stored in the data centers of the third party company that provides the invoicing web app. This proprietary information can be regulated by the customer in order to control how much transactional information the vendor is allowed to see. (For example, payment dates, or check information).[13]

As companies advance into the digital era, more and more are switching to electronic invoicing services to automate their accounts payable departments. Some even believe it to be an industry standard in the near future. According to a report done by the GXS team in 2013, Europe is adopting government legislation encouraging businesses to adopt electronic invoicing practices. The United States has no such legislation yet but does recognize the value of this technology. The US Treasury estimated that implementing e-invoicing across the entire federal government would reduce cost by 50% and save $450 million annually.[14]

Best Accounts Payable Automation

With the increasing availability of robotic solutions, businesses are driving process improvement in AP even further. By applying end-to-end robotic process automation or RPA to their accounts payable department, organizations can accelerate invoice processing speed and accuracy while improving operational costs.[15] Some organizations report that by implementing RPA they have managed to almost completely eliminate human intervention from the AP process, thus saving 65% to 75% of the time that was previously had spent on manual processing.[16]

See also[edit]

Best Practices Accounts Payable Automation

| Look up accounts payable in Wiktionary, the free dictionary. |

References[edit]

- ^Needles, Belverd E.; Powers, Marian; Crosson, Susan V. (23 February 2010). Financial & Managerial Accounting. - Belverd E. Needles, Marian Powers, Susan V. Crosson - Google Boeken. ISBN978-1439037805. Retrieved 2013-11-29.

- ^'What does 2/10 net 30 mean? Make early payments a reality'. Tipalti. 2018-02-09. Retrieved 2018-08-24.

- ^Schaeffer, Mary S. (2007). Controller and CFOs Guide to Accounts Payable. John Wiley & Sons. ISBN978-0-471-78589-7.

- ^'The Invoice Approval Process'. AccountingTools. Retrieved 2013-11-29.

- ^Schaeffer, Mary S. (2006). Accounts Payable & Sarbanes Oxley: Strengthening Your Internal Controls. John Wiley & Sons. ISBN0-471-78588-1.

- ^Elmore, Christopher (2011). The 8 Pitfalls of Accounts Payable Automation. NC: CreateSpace. p. 198. ISBN978-1-4610-3996-9.

- ^Accounting Tools. (2013). Accounts Payable Controls. Retrieved from accounting tools: http://www.accountingtools.com/accounts-payable-controls

- ^The Aberdeen Group: Scott Pezza, w. j. (2010, October). The E-payables Solution Selection Report: A Buyer's Guide to Accounts Payable optimization, page 4. Retrieved from www.adp.com: 'Archived copy'(PDF). Archived from the original(PDF) on 2014-01-23. Retrieved 2013-06-14.CS1 maint: archived copy as title (link)

- ^Aberdeen Group: Scott Pezza, W. j. (2010, October). The E-payables Solution Selection Report: a buyer's Guide to Accounts Payable Optimization, pg. 8. Retrieved from ADP: 'Archived copy'(PDF). Archived from the original(PDF) on 2014-01-23. Retrieved 2013-06-14.CS1 maint: archived copy as title (link)

- ^tieto. (2009). The future of e-invoicing, Pg. 5. Retrieved from digitdoc: 'Archived copy'(PDF). Archived from the original(PDF) on 2012-10-21. Retrieved 2013-06-17.CS1 maint: archived copy as title (link)

- ^Mayes, Cyril; Dyer, John (1 October 2015). 'SMB Automation of Accounts Payable and Accounts Receivable'. International Journal of Business Research. 15 (3): 37–54. doi:10.18374/IJBR-15-3.4.

- ^Hill, M. G. (n.d.). A brief history of Electronic Data Interchange, pg 6. Retrieved from BizTalk Server 2000: A beginner's Guide: http://books.mcgraw-hill.com/downloads/products/0072190116/0072190116_ch01.pdfArchived 2014-03-09 at the Wayback Machine

- ^GXS. (2013). A brief history. Retrieved from eInvoicing basics: http://www.einvoicingbasics.co.uk/what-is-e-invoicing/a-brief-history/

- ^Bruno Koch, G. (2013, April). E-Invoicing/ E-Billing. Retrieved from GSX: http://www.gxs.co.uk/wp-content/uploads/billentis-2013-report.pdf

- ^'Article : Robotic Process Automation in Accounts Payable – Tomorrow is Today'. wns.com. Retrieved 2016-07-29.

- ^'KPMG Strategic Visions On The Sourcing Market 2016'. 2016-04-13.Cite journal requires

|journal=(help)